Welcome to Haripay – Your Trusted BBPS Bill Payment Platform

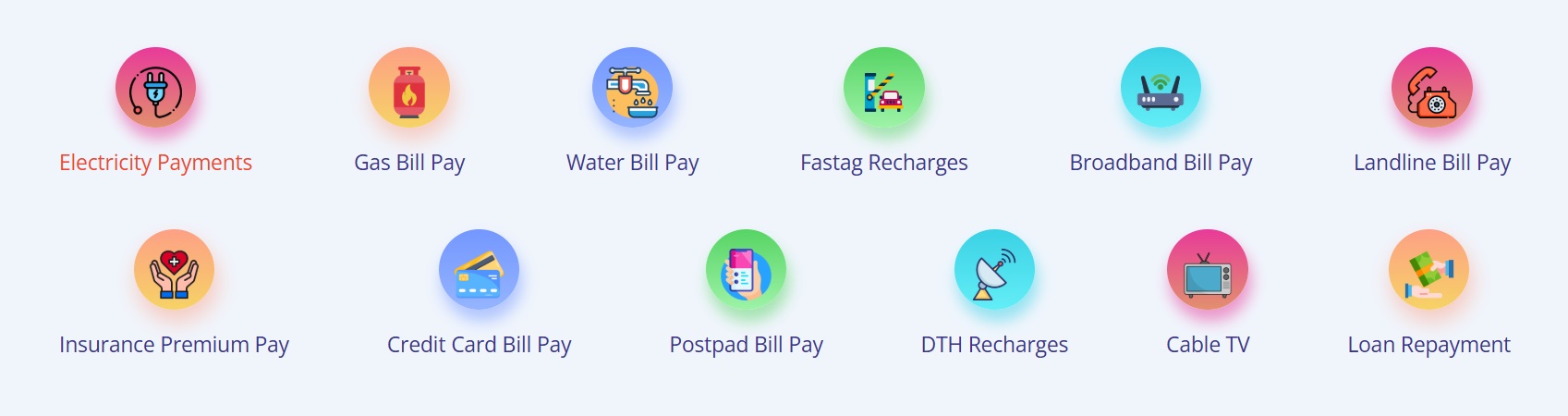

Haripay is a secure and easy-to-use digital payment platform powered by the Bharat Bill Payment System (BBPS). We offer a seamless solution for paying all your utility bills — anytime, anywhere. From electricity, gas, water, and DTH to mobile recharges, EMIs, and more — Haripay brings all your essential bill payments under one roof.

Stay connected with hassle-free prepaid recharges and postpaid bill payments.

Pay for your broadband and landline services instantly with Haripay.

Pay your electricity bills quickly and securely with Haripay.

Avoid the hassle of standing in queues. Pay your water utility bills online with just a few clicks.

Pay your piped gas bills or LPG cylinders using our secure BBPS-Platform

Recharge your DTH connection effortlessly through Haripay for all major DTH operators like Tata Play, Dish TV, Airtel Digital TV etc.

Never miss an EMI or credit card due date. Haripay helps you manage payments in one place.

Pay for recurring subscriptions, OTT platforms, Magazines, Online Services and LIC premiums with ease.

⚡ Pay All Your Bills Instantly via BBPS

Transaction Solutions at Haripay

At Haripay, we simplify the way India pays. Our advanced transaction solutions are designed to support fast, secure, and real-time financial transactions — for individuals, businesses, and agents. Whether it’s domestic bill payments, UPI transactions, or international transfers, Haripay is your trusted partner for all payment solutions.

-

🔌 BBPS – Bharat Bill Payment SystemHaripay is powered by BBPS (Bharat Bill Payment System) – an RBI-governed, NPCI-operated unified platform that allows customers to pay utility bills instantly and securely. Key Features: 🎯 Supports Electricity, Gas, Water, DTH, Mobile, EMI, Insurance & more 🎯 Real-time bill fetch & instant payment confirmation 🎯 Available 24/7 – via website or app 🎯 Fully secure, compliant, and digitally verified system Ideal for: Customers, Retailers, Agents, and Fintech Resellers

-

📲 UPI PaymentsExperience the power of real-time money transfer with UPI (Unified Payments Interface) integration at Haripay. We provide seamless peer-to-peer (P2P) and merchant (P2M) UPI solutions for fast, secure, and instant fund transfers. Key Highlights: 🎯 UPI Push & Pull support (Send/Request money) 🎯 QR Code-based payments for merchants 🎯 UPI ID creation and linking 🎯 Instant transaction updates & confirmation Use Cases: Customer payments, merchant billing, microtransactions, recharge apps

-

💸 Pay-outs (Bulk & Individual)Our Pay-out Solution enables businesses, platforms, and agents to disburse funds quickly to vendors, users, employees, or customers through a highly secure API infrastructure. 🎯 Supported Pay-out Modes: 🎯 IMPS / NEFT / RTGS 🎯 UPI Pay-outs 🎯 Bank Account Transfers 🎯 Wallet to Bank Settlement

-

🌐 Cross-border PaymentsExpand your business globally with our Cross-border Payment Gateway. We simplify international remittances and currency conversion with a secure, regulatory-compliant process. 🎯 Services Include: 🎯 Send/Receive money internationally 🎯 FX rate optimization 🎯 Support for B2B, B2C, and freelancer transactions 🎯 Partnered with trusted global remittance networks Ideal For: Exporters, freelancers, international agencies, overseas clients

Leader in cybersecurity and data protection

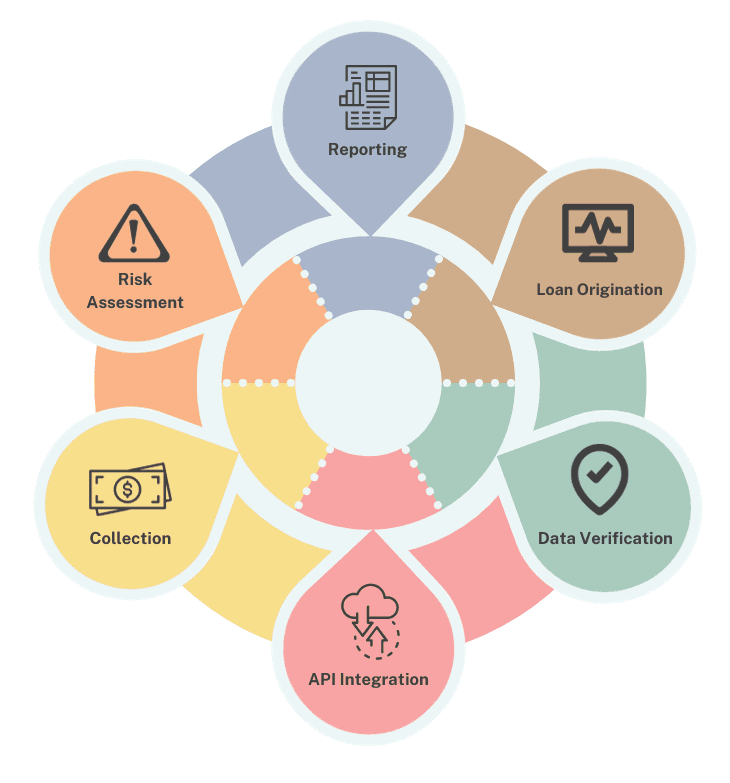

At Haripay, we empower digital lending with scalable, secure, and intelligent solutions. Our technology-driven lending suite enables NBFCs, fintechs, banks, and startups to manage end-to-end lending workflows — from origination to disbursement to repayment — with complete transparency and automation.

At Haripay, we simplify the way India pays. Our advanced transaction solutions are designed to support fast, secure, and real-time financial transactions — for individuals, businesses, and agents. Whether it’s domestic bill payments, UPI transactions, or international transfers, Haripay is your trusted partner for all payment solutions.

-

📋 Loan Management System (LMS)Our Loan Management System is a robust back-end solution that simplifies the tracking, servicing, and monitoring of loans throughout their lifecycle. Key Features: 🎯 Automated EMI scheduling & repayment tracking 🎯 Centralized borrower database with KYC integration 🎯 Delinquency alerts & NPA management 🎯 Reporting, accounting, and compliance-ready modules Ideal For: NBFCs, Microfinance Institutions, Credit Platforms

-

🔍 Loan Origination System (LOS)Speed up your lending process with our smart and customizable Loan Origination System, designed to handle loan applications efficiently — from onboarding to approval. Highlights: 🎯 Digital KYC & document verification 🎯 Credit scoring & underwriting automation 🎯 Multi-channel loan application support (web, app, API) 🎯 Real-time status tracking for borrowers & lenders Use Cases: Personal loans, business loans, vehicle loans, education loans

-

🛒 BNPL Platform (Buy Now, Pay Later)Offer customers the convenience of Buy Now, Pay Later (BNPL) with our ready-to-integrate platform. Perfect for e-commerce, travel, and retail partners looking to boost sales and customer loyalty. Core Capabilities: 🎯 Instant credit check & approval 🎯 Flexible tenure-based repayments 🎯 Merchant dashboards for settlements 🎯 Real-time transaction sync with POS or checkout systems Target Users: Online shoppers, students, gig workers, and salaried users

-

💳 Credit Line on UPIBring the future of lending to the present with UPI-linked Credit Lines. Users can make purchases or payments using a pre-approved credit limit via UPI. Key Features: 🎯 Seamless UPI QR/ID-based transactions 🎯 Instant disbursal from credit wallet 🎯 Transparent billing & repayment alerts 🎯 RBI and NPCI compliant architecture Use Case: Daily spends, emergency needs, working capital for small vendors

Integrate Bharat Bill Payment System (BBPS) services into your app, website, or platform with the powerful and secure HariPay BBPS API. Enable your users to fetch and pay utility bills in real-time across India with a simple and reliable API architecture. Whether you are a startup, a fintech company, or an agent, our BBPS API brings unmatched convenience and speed to your billing ecosystem.

-

📂 Select the CategoryStart the bill payment journey by selecting the correct service category. Our API supports all major BBPS-enabled categories: 🎯 Electricity 🎯 Water 🎯 Gas 🎯 Broadband 🎯 Mobile Postpaid 🎯 Landline 🎯 DTH 🎯 Loan EMI 🎯 Insurance Premiums 🎯 Fastag Recharge …and many more! Just pass the category code via API to fetch the supported billers in real-time.

-

🧾 Choose the BillerOnce the category is selected, you can retrieve a dynamic list of available billers (service providers) based on the user’s region or input. 🎯 Our system provides: 🎯 Biller ID & Name 🎯 Input parameters required (like Consumer Number, Mobile, etc.) 🎯 Payment modes accepted 🎯 Due date availability This ensures accuracy and a smooth customer experience.

-

🔍 3. Fetch the BillFetch live bill data directly from the selected biller’s database through BBPS. 🎯 With one API call, you get: 🎯 Bill Amount 🎯 Due Date 🎯 Customer Name 🎯 Bill Period 🎯 Additional Charges or Rebates This real-time validation ensures that the customer sees the correct and up-to-date bill details before payment.

-

💳 Make the Bill PaymentOnce the bill is confirmed, proceed to payment using our secure and fast payment gateway. HariPay supports: 🎯 Net Banking 🎯 UPI 🎯 Debit/Credit Cards 🎯 Wallets 🎯 Agent Wallet (for retailers) After successful payment, instant confirmation is sent via API, and a digital receipt is generated — ensuring complete transparency and traceability.

🔐 AEPS – Aadhaar Enabled Payment System

-

📂 AEPS system at HariPayThe AEPS system at HariPay allows users to perform financial transactions using: 🎯 Aadhaar Number 🎯 Bank Name (linked with Aadhaar) 🎯 Biometric Verification (Fingerprint Scanner) Fully integrated with NPCI’s Aadhaar Payment Bridge System (APBS), our AEPS solution supports multiple banks and is compliant with the latest RBI and UIDAI regulations.

-

💵 Cash WithdrawalLet your customers withdraw cash instantly from their Aadhaar-linked bank accounts using their fingerprint. 🎯 Key Features: 🎯 Instant fund access 🎯 No ATM or debit card required 🎯 Secure biometric verification 🎯 Works even in remote villages Perfect for customers in rural India who may not have easy access to banking infrastructure.

-

💰 Cash DepositAllow users to deposit cash into their bank accounts through your retail outlet using AEPS. Highlights: 🎯 Supports major Indian banks 🎯 Instant deposit confirmation 🎯 Printed or digital receipts 🎯 Seamless agent commission tracking Retailers can act as mini-banks, helping improve financial inclusion.

-

🔄 Fund TransferEnable customers to send money from their Aadhaar-linked bank account to another bank account easily. Use Cases: 🎯 Domestic remittance 🎯 Family support transfers 🎯 Rural-to-urban worker remittances Fast, secure, and authenticated — AEPS Fund Transfer is a reliable way to move money without cards or apps.

Haripay is integrated with NPCI's BBPS system, ensuring 100% secure, real-time transactions with instant confirmation. Say goodbye to long queues and multiple payment apps.

✅ Supported Services:

🔌 Electricity Bill Payment

💧 Water Bill Payment

📡 DTH Recharge

📱 Prepaid & Postpaid Mobile Recharge

🏦 Loan EMI Payment

🔥 Gas Cylinder Booking

📚 Subscription Services

📶 Broadband & Landline Payments

- Quick response

- Save time & money

Become an Agent / Partner With Us

Form and details for those interested in becoming Haripay agents or white-label resellers.

Banking and Finance Attractive Commission on Every Transaction

💰 In today’s digital era, offering financial and utility services is not just

Banking and Finance Start With Minimal or Zero Investment

🚀 In today’s digital economy, everyone wants to earn more, become independent

Banking and Finance One Platform – Multiple Services

🌐 In today’s fast-paced digital world, convenience, speed, and accessibility

Being back with ITLab just gives me peace of mind knowing that my technology is functioning seamlessly behind the scenes without it interfering with and disrupting our day-to-day operations.

Being back with ITLab just gives me peace of mind knowing that my technology is functioning seamlessly behind the scenes without it interfering with and disrupting our day-to-day operations.

Being back with ITLab just gives me peace of mind knowing that my technology is functioning seamlessly behind the scenes without it interfering with and disrupting our day-to-day operations.

Being back with ITLab just gives me peace of mind knowing that my technology is functioning seamlessly behind the scenes without it interfering with and disrupting our day-to-day operations.

Being back with ITLab just gives me peace of mind knowing that my technology is functioning seamlessly behind the scenes without it interfering with and disrupting our day-to-day operations.

Being back with ITLab just gives me peace of mind knowing that my technology is functioning seamlessly behind the scenes without it interfering with and disrupting our day-to-day operations.

Being back with ITLab just gives me peace of mind knowing that my technology is functioning seamlessly behind the scenes without it interfering with and disrupting our day-to-day operations.

Being back with ITLab just gives me peace of mind knowing that my technology is functioning seamlessly behind the scenes without it interfering with and disrupting our day-to-day operations.

Being back with ITLab just gives me peace of mind knowing that my technology is functioning seamlessly behind the scenes without it interfering with and disrupting our day-to-day operations.

Being back with ITLab just gives me peace of mind knowing that my technology is functioning seamlessly behind the scenes without it interfering with and disrupting our day-to-day operations.

Being back with ITLab just gives me peace of mind knowing that my technology is functioning seamlessly behind the scenes without it interfering with and disrupting our day-to-day operations.

Being back with ITLab just gives me peace of mind knowing that my technology is functioning seamlessly behind the scenes without it interfering with and disrupting our day-to-day operations.

Let’s get started

Still have questions?

Customer Success Stories

See how Haripay has helped businesses.

Get award winning service

We’re honoured to have been recognised

Get a free consultation

Talk to our product analytics expert.